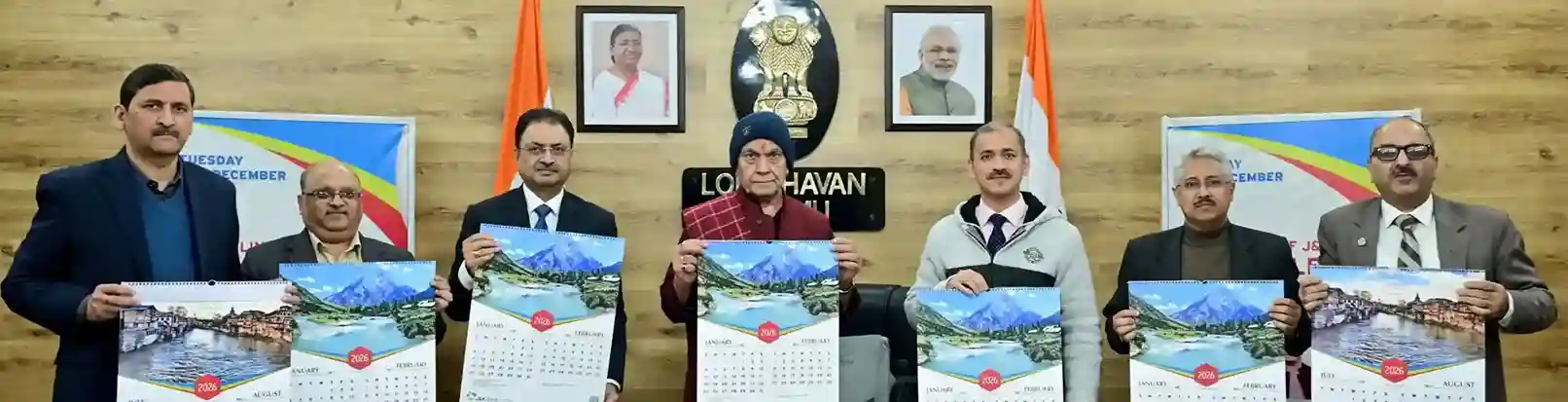

Lieutenant Governor Manoj Sinha on Tuesday unveiled the 2026 Wall and Table Calendars of Jammu & Kashmir Bank at Lok Bhavan.

The Wall Calendar for 2026 is based on the theme “Rivers of J&K and Ladakh”, while the Table Calendar highlights historic places of the region. Both calendars show the rich natural beauty and cultural heritage of the Union Territories of Jammu & Kashmir and Ladakh.Click Here To Follow Our WhatsApp Channel

The Lieutenant Governor praised J&K Bank for choosing meaningful themes. He said these calendars will help create awareness about protecting ancient monuments, heritage sites, traditions, and natural resources for future generations. He stressed that society must work together to preserve these valuable treasures.

Manoj Sinha also spoke about the importance of protecting rivers and water bodies. He said rivers in Jammu & Kashmir are a major source of fresh water, help in food security, and support biodiversity. He urged people and communities to come forward to protect rivers and ecosystems to face future climate challenges.

Amitava Chatterjee, Managing Director and CEO of J&K Bank, said the 2026 calendars honour rivers that support life and historic places that reflect the region’s shared legacy.

The calendars also highlight public welfare schemes such as Mission YUVA and PM Surya Ghar Muft Bijli Yojana. In addition, they feature J&K Bank’s services like Housing Loans, Car Loans, Personal Consumption Loans, and Online Account Opening, showing the bank’s role in supporting people’s aspirations and development.

Senior officials present at the event included Santosh D. Vaidya, Principal Secretary, Finance Department; Dr Mandeep K. Bhandari, Principal Secretary to the Lieutenant Governor; Sudhir Gupta, Executive Director; and Sunit Kumar and Imtiyaz Ahmad, Chief General Managers of J&K Bank.

You Might Also Like:

Al-Tilmeez: A Pioneering Arabic Literary Journal from Jammu and Kashmir

Professor Mufti Abdul Ghani Azhari: Scholar, Sufi, Historian, and Social Reformer of Kashmir

Mirwaiz Mohammad Ahmad son of Mufasir-e-Quran Moulana Mohammad Yousuf Shah Dies in Islamabad